Markets

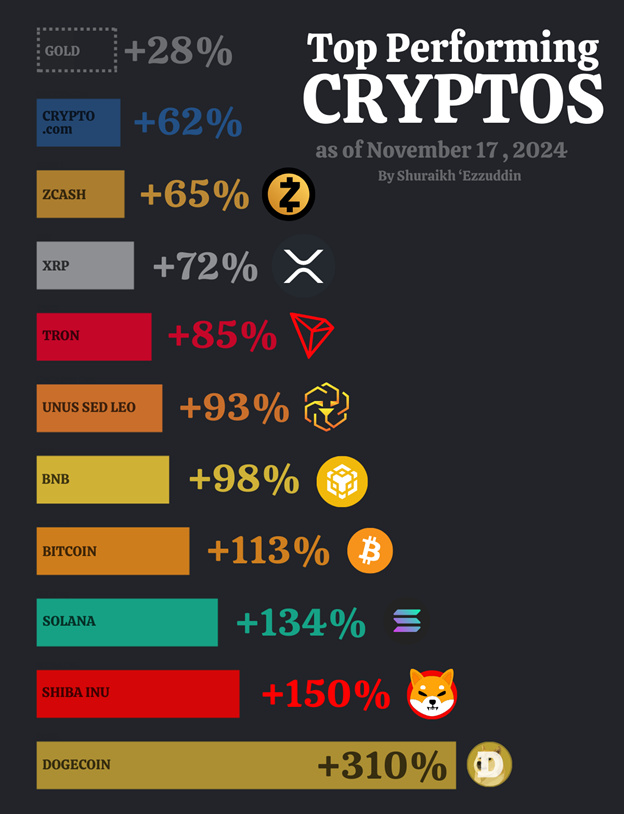

Top Performing Cryptocurrencies as of November 17, 2024

The cryptocurrency market in 2024 has proven to be one of the most profitable investment avenues, significantly outperforming traditional asset classes like stocks, ETFs, and even heavy metals like gold. Dogecoin’s stunning 310% gain has crowned it the top-performing asset this year, with other cryptocurrencies such as Shiba Inu (+150%), Solana (+134%), and Bitcoin (+113%) trailing closely behind.

Cryptocurrencies vs. Traditional Assets

-

Gold (+28%):

While gold traditionally serves as a safe haven during economic uncertainty, its 28% gain in 2024 is modest compared to crypto assets. Investors seeking higher risk-adjusted returns have leaned toward cryptocurrencies, particularly with rising adoption and institutional interest. -

ETFs:

The average performance of major ETFs, including those tracking the S&P 500, Nasdaq-100, and other global indices, hovered between 8%-15% in 2024. Cryptocurrencies have significantly outperformed these instruments, indicating a higher appetite for risk among investors amid loosening monetary policies. -

Stocks:

Key stock indices like the S&P 500 and the Dow Jones Industrial Average recorded average returns of 10%-12% for the year. Individual tech stocks showed promise, but none matched the staggering growth of assets like Dogecoin and Solana. -

Heavy Metals:

Silver (+15%) and platinum (+12%) also saw moderate gains but could not rival crypto's meteoric rise. With the dollar losing strength in global markets, metals provided stability but failed to attract the speculative capital that flowed into digital assets.

Key Market Scenarios

-

Meme Coin Dominance:

Dogecoin (+310%) and Shiba Inu (+150%) continue to dominate headlines, driven by speculative retail trading, celebrity endorsements, and renewed interest in meme coins. This trend showcases the unique speculative culture in the crypto space. -

Layer-1 Blockchain Gains:

Solana (+134%) and Binance Coin (BNB, +98%) benefited from growing ecosystems, innovative DeFi platforms, and NFT adoption. Their performance signals the increasing maturity of blockchain technology and its practical applications. -

Bitcoin’s Stability:

Bitcoin (+113%) maintained its dominance as a digital store of value. Despite its lower percentage gains compared to meme coins, Bitcoin’s institutional adoption and recognition as “digital gold” reinforce its role in diversified portfolios. -

Broader Altcoin Market Growth:

Assets like XRP (+72%), Tron (+85%), and Unus Sed Leo (+93%) performed strongly, reflecting their resilience and utility within niche markets.

Outlook for 2024 and Beyond

Cryptocurrencies have proven to be both high-risk and high-reward. As inflation fears ease and central banks adopt dovish stances, investors are likely to continue seeking higher returns in crypto markets compared to traditional assets.

However, risks such as regulatory crackdowns, volatility, and macroeconomic uncertainty still loom. Comparatively, ETFs, stocks, and metals offer more stable, albeit lower, returns, appealing to conservative investors.

For now, crypto assets dominate the conversation, with Dogecoin leading the charge as the year's top performer. Will 2025 extend this surge, or will traditional markets regain dominance? Only time will tell.

Markets Articles

insightHub

Your one-stop hub for the knowledge and insights you need to thrive in today's dynamic business landscape.

Headquarters

InfoCenter Sdn. Bhd

202201006129 (1451826P)

No. 111-2, Wisma PPC,

Jalan Dwitasik 1,

Dataran Dwitasik, Permaisuri,

56000 Kuala Lumpur

+603 9173 0045 / +603 9173 0142

.png)

.jpg)