Markets

Comparing Malaysia’s Dividend Portfolios (2000–2023)

.png)

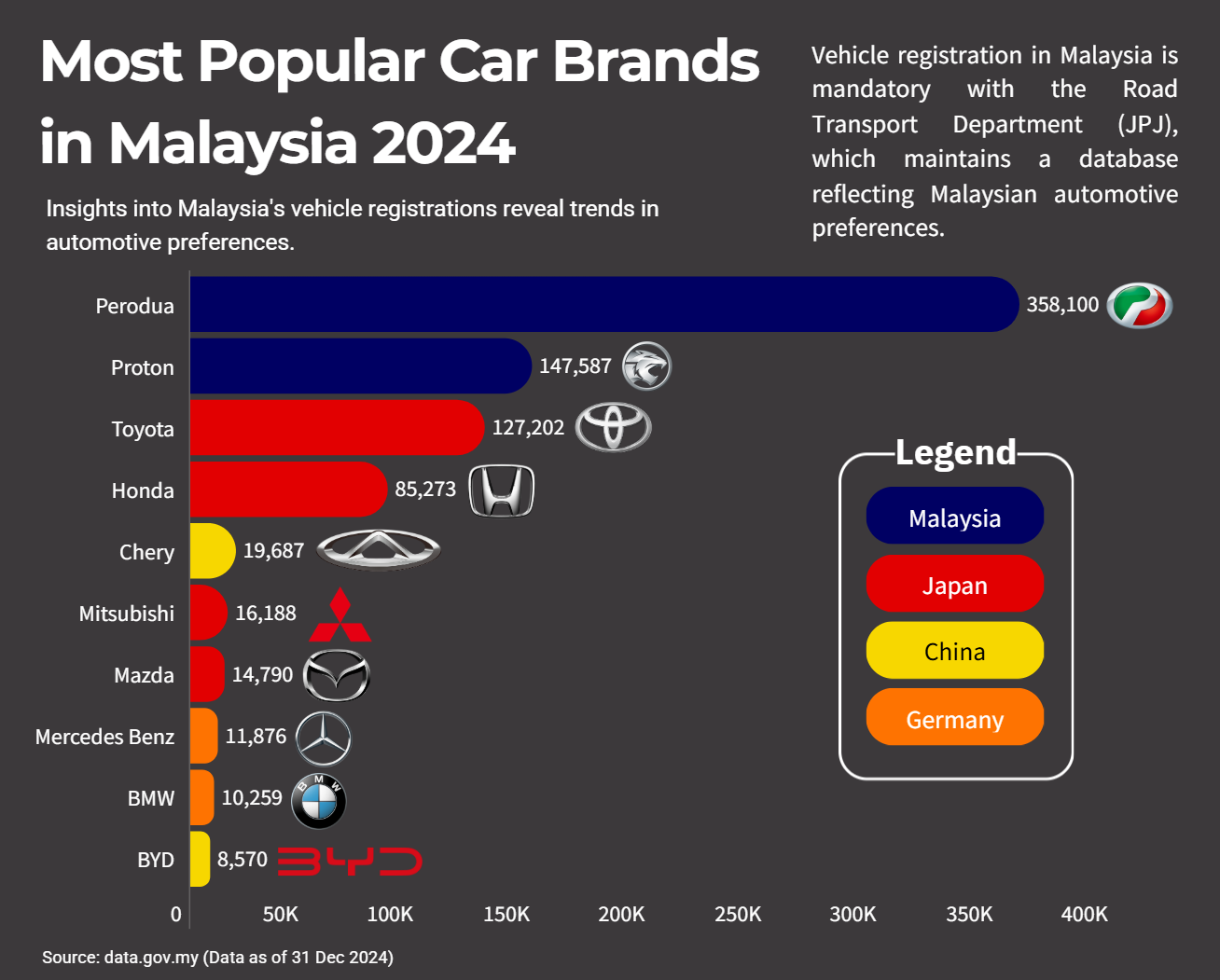

When it comes to managing finances, Malaysians have diverse options tailored to unique goals—whether building wealth, planning for retirement, or saving for religious obligations. This article explores the performance of four major portfolios—ASB 1, Tabung Haji, KWSP Conventional, and KWSP Shariah—shedding light on their strengths, challenges, and alignment with financial goals.

Yearly Dividend Rates:

.jpg)

ASB 1 – The Investment Powerhouse

ASB 1 (Amanah Saham Bumiputera) has been a top choice among Bumiputera investors for its consistent wealth-building potential. In 2000, ASB 1 delivered a remarkable 11.75%, solidifying its dominance in the investment landscape.

While its returns have declined over the years, settling at 5.25% in 2023, ASB 1 continues to outperform during economic booms. Its stability and competitive returns make it a cornerstone for long-term financial growth strategies.

Tabung Haji – Savings with a Spiritual Purpose

Tabung Haji uniquely blends savings with the goal of fulfilling the Hajj pilgrimage. Its peak dividend rate of 8.25% in 2014 reflects its earlier financial strength. However, dividends dropped significantly post-2015, stabilising at 3.10% in 2023.

Tabung Haji’s value goes beyond dividends. It provides subsidies for pilgrimage expenses, making it an invaluable purpose-driven fund for Muslims preparing for this sacred journey.

KWSP Conventional – Securing Retirements with Stability

The Employees Provident Fund (KWSP Conventional) portfolio serves as Malaysia’s primary retirement savings vehicle, known for its steady performance. Over the years, dividends have ranged between 5% and 6%, peaking at 6.9% in 2017.

Despite economic fluctuations, KWSP Conventional delivered a competitive 5.50% in 2023. This stability ensures retirees can rely on a consistent and predictable income stream, making it ideal for long-term financial security.

KWSP Shariah – Faith-Aligned Retirement Savings

Launched in 2017, KWSP Shariah caters to Malaysians seeking a Shariah-compliant retirement fund. Its initial returns mirrored the conventional fund, peaking at 6.40% in its launch year. In 2023, it offered 5.40%, closely tracking its conventional counterpart.

What sets KWSP Shariah apart is its commitment to Shariah-compliant investments, appealing to contributors who prioritise ethical financial practices without compromising on returns.

Key Trends and Insights

-

ASB 1 Dominates Long-Term Growth:

Its high returns make it a reliable choice for wealth creation over decades. -

Tabung Haji’s Adaptability:

Despite challenges, it remains essential for faith-driven savers. -

Conventional vs. Shariah Options:

KWSP Conventional slightly outpaces Shariah, though both deliver solid returns. -

Post-2015 Shifts:

A general decline in dividend rates reflects broader economic trends, highlighting the need for diversified investment strategies.

Tailoring Financial Strategies to Goals

Each portfolio serves a distinct purpose, offering unique strengths:

-

ASB 1 excels at long-term investment-focused wealth creation.

-

Tabung Haji fulfills faith-driven financial goals with modest returns.

-

KWSP Conventional ensures a stable retirement fund, while KWSP Shariah appeals to ethical investors.

By leveraging these portfolios, Malaysians can build diversified strategies to balance risk, returns, and personal values.

Conclusion: A Portfolio for Every Goal

Whether you prioritise wealth-building, retirement security, or fulfilling religious obligations, understanding the strengths of these portfolios empowers you to make informed decisions. Align your financial choices with your goals and values to secure a brighter financial future.

Markets Articles

insightHub

Your one-stop hub for the knowledge and insights you need to thrive in today's dynamic business landscape.

Headquarters

InfoCenter Sdn. Bhd

202201006129 (1451826P)

No. 111-2, Wisma PPC,

Jalan Dwitasik 1,

Dataran Dwitasik, Permaisuri,

56000 Kuala Lumpur

+603 9173 0045 / +603 9173 0142

.jpg)